Greece Macroeconomic Analysis and Stock Market Outlook

Greek Economic Overview

Greece’s economy has been showing signs of resilience despite global challenges. Key indicators such as GDP growth, unemployment rate, and inflation suggest a stable, though somewhat cautious, economic outlook for 2024. Below is a brief overview of Greece’s recent macroeconomic performance:

- GDP Growth Rate: Greece’s economy grew by 1.1% in Q2 2024, showing a positive trend from the previous quarter (0.8%). Annual GDP growth stands at 2.3%, supported by rising consumer spending and investments in infrastructure.

- Unemployment Rate: The unemployment rate decreased to 9.5% in August 2024, its lowest level since the 2008-2010 financial crisis. This marks improved labor market conditions, especially in construction and services.

- Inflation Rate: Inflation accelerated to 3% in August 2024, a four-month high, driven by rising food, housing, and clothing costs. Despite this, inflation remains relatively moderate compared to historical levels.

- Interest Rates: The Bank of Greece, which operates within the framework of the ECB has lowered its key interest rate to 3.65% from 4.25% in September 2024, a move aimed at stimulating economic growth. This could provide a tailwind for equity markets and domestic consumption.

- Balance of Trade: Greece’s trade deficit narrowed to EUR 2.5 billion in August, as imports declined more sharply than exports. This indicates an improved external trade environment.

Sources: ELSTAT, Bank of Greece, ECB, Eurostat, commentary by J. Knobel Investor Services Limited

Greek Stock Market Outlook

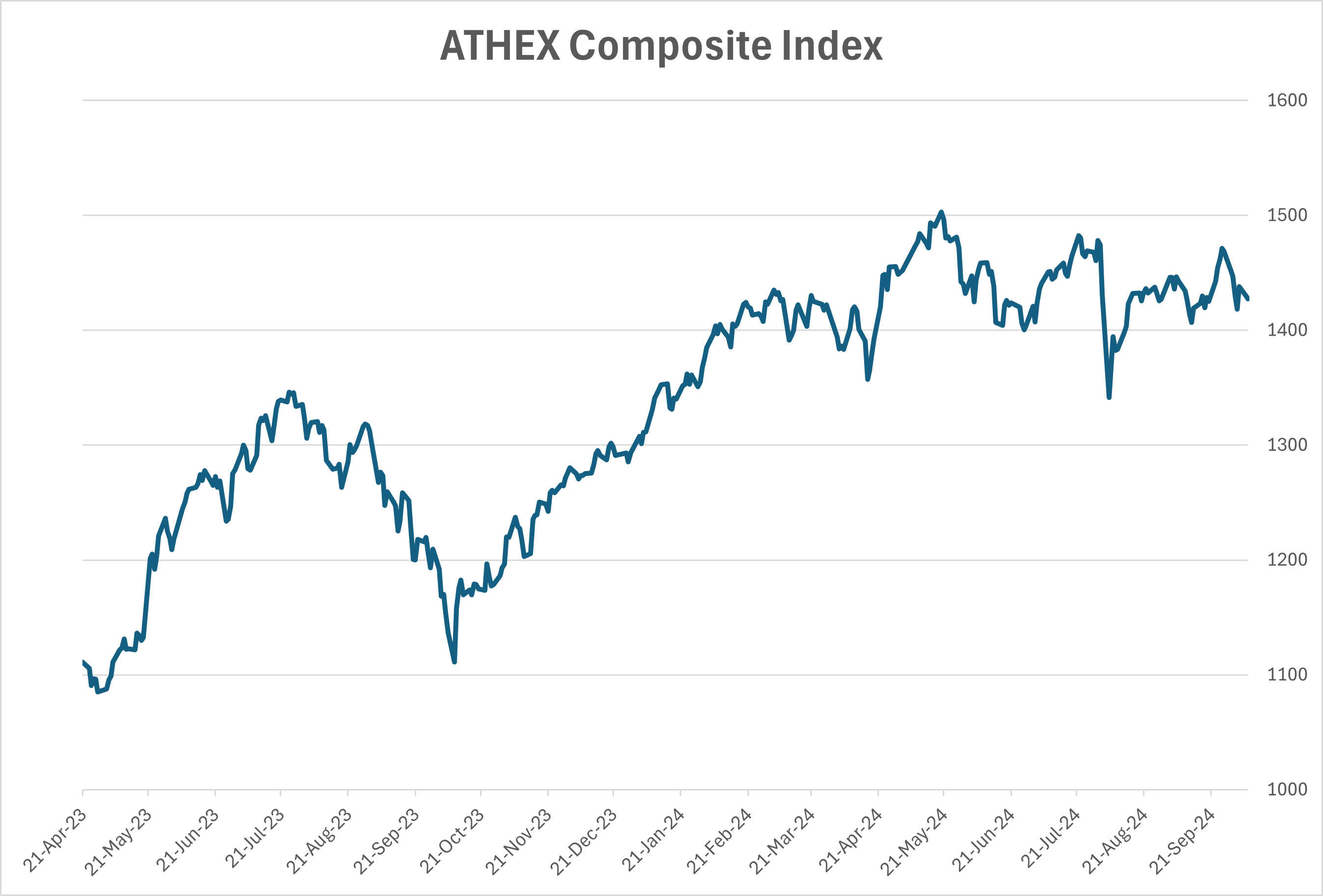

The Athens General Stock Index (ASE) currently stands at 1,427 points (end of day value on Oct 8, 2024), showing resilience in the face of global economic uncertainty. The lower interest rates and a positive outlook from rating agencies like Moody’s, which upgraded Greece’s outlook to “positive”, suggest that Greek stocks are likely to experience upward momentum in the near term. The recovery in tourism, infrastructure investments, and improved consumer demand should further support growth in key sectors.

source: ATHEX Oct 8th, 2024 / J. Knobel Investor Services Limited

Bottom Line for Greece in General

The Greek economy is on a steady recovery path, supported by improving credit conditions, declining unemployment, and sustained fiscal discipline. While inflation poses a challenge, it remains within manageable levels. The easing of producer price pressures and favorable interest rates are likely to boost corporate profits and stock market performance. As such, investors can expect moderate gains in the Athens General Index, with cyclical and growth-oriented sectors such as financials, energy, and industrials leading the charge.

Prepared by:

John Knobel, Managing Director

J. Knobel Investor Services Limited

Office: +357 22 258 790 (Recorded line)